Two Days at Blockbuster 📼

The graveyards of history are littered with organizations that pioneered one way of doing things but failed to transition to the next model.

I can’t think of a better illustration than two days—ten years apart—at this little company called Blockbuster.

So much of the discourse about a company like Blockbuster over the past 15 years has been about the cautionary tale – the company that missed out on the transition to streaming video and went out of business.

However, focusing only on the company’s downfall misses a much more interesting point. Just a generation prior, Blockbuster literally invented a new category of video rental. They pioneered a new model for doing things and were wildly successful.

How could such a wild success in one generation turn into a miserable failure in the next?

Above: Blockbuster Video invented an entirely new category of video rental chain based on selection, great store design, and consistent customer experience. There were the innovators in the category. (Image Credit: The Last Blockbuster in Bend, OR, Wikimedia Commons)

We recently had the opportunity to interview Tom Beck on the Purpose & Profit Podcast, a show I co-host about discovering ideas at the intersection of for-profit businesses and nonprofit causes.

Tom opened the third-ever Blockbuster store, so he was there at the very beginning. In just three years, his group alone opened about 125 stores. He was on the ground floor of an entirely new business model, innovating the way video rental happened at scale.

I was fascinated to ask Tom about the early era of Blockbuster. Today, he serves as the Chief People & Culture Officer at Compassion International, one of the world’s largest charities with “a long-term, child focused, church driven and Christ centered approach to fighting child poverty.”

You can listen to our conversation with Tom at:

Season 4, Episode 5 | Purpose & Profit Podcast

Leadership Lessons from Blockbuster, Boston Market, and Compassion International with Tom Beck

The genius behind Blockbuster was that it became the superstore.

Tom describes how, when Blockbuster entered the market, “there were about 40,000 video stores, but they were all small mom-and-pop stores.”

Blockbuster would be family-friendly – no adult entertainment. They had bright lights and spacious stores. The videos were all out on the floor. They used a bar-coded inventory system that enabled them to use data like no other video store had ever done. Blockbuster could tailor its inventory to each location's demographics and rental patterns.

So how could an organization that invented a category in one era go out of business in the next?

Blockbuster failed to transition from one model to the next.

Blockbuster confused its model – renting physical media in a store location – with its mission – delivering entertainment with a consistent experience.

Blockbuster invented one model but failed to transition to the next model, and in one generation, it ceased to exist. It focused on VHS tapes and DVDs and late fees and ultimately failed to make the changes needed to continue accomplishing its mission.

It's a sobering tale and one that nonprofit leaders can learn from.

To illustrate the lessons we can learn, let’s look at two days at Blockbuster, almost exactly ten years apart.

Living High – September 2000

Imagine this. You’ve just gone through an IPO the year before. You’re a publicly traded company that has just raised $450 million in cash. Your company exploded in growth for the first decade, and while things have slowed a bit lately, you are supremely confident – you have thousands of stores. A brand name that everyone knows. Revenues are up, and your stock price has doubled.

You’re in your spacious boardroom on the 23rd floor of the tallest building in Dallas, surrounded by gilded frames of all the films you’ve made massive profits from over the past 15 years. You invented a new way to rent and experience movies.

You have a meeting today with three guys from an upstart little online company called Netflix – Reed Hastings, CFO Barry McCarthy, and then-CEO Marc Randolph.

The truth is, they are desperate. They are burning through cash, and Netflix needed Blockbuster more than it needed them. Marc Randolph writes about the meeting: “There’s nothing like going into a negotiation knowing that the other side holds almost all the cards.”

Reed Hastings laid out a case for joining forces with Blockbuster – Netflix would handle the online part of the business, and Blockbuster would focus on the stores, with both looking for synergies from the combination.

What happened next said everything that we need to know about how Blockbuster, then in a place of strength, had already planted the seeds of its own demise.

“The dot-com hysteria is completely overblown,” Antioco said. Stead informed us that the business models of most online ventures, Netflix included, just weren’t sustainable. They would burn cash forever.

I won’t recount the entire meeting here. But it culminated with a buyout offer from Netflix for $50 million. Blockbuster CEO John Antioco could hardly suppress laughing out loud.

Today, Netflix is worth $274 billion. On a $50 million investment, that would have been an incredible return!

For a full recounting of the meeting, I highly recommend Marc Randolph’s telling, published in a Built In article titled “We Pitched Netflix to Blockbuster. They Laughed Us Out of the Building.”

💡 Takeaway: In 2000, Blockbuster was riding high and in a place of strength. But the cracks were already starting to show, and their hubris foreshadowed their eventual downfall.

Fast forward ten years later to the same spacious boardroom.

Blockbuster has just declared bankruptcy.

The End – September 23, 2010

I imagine the boardroom looked similar, gilded with posters of movies past. But this time, the mood was entirely different.

The company has just declared bankruptcy. CEO John Antioco left the company in 2007 over a fight with an activist investor. After failing to convince investors to invest big in online streaming and eliminating late fees, the company peaked in 2004 and started to slide, slowly at first, but by 2009, it had reached a cliff.

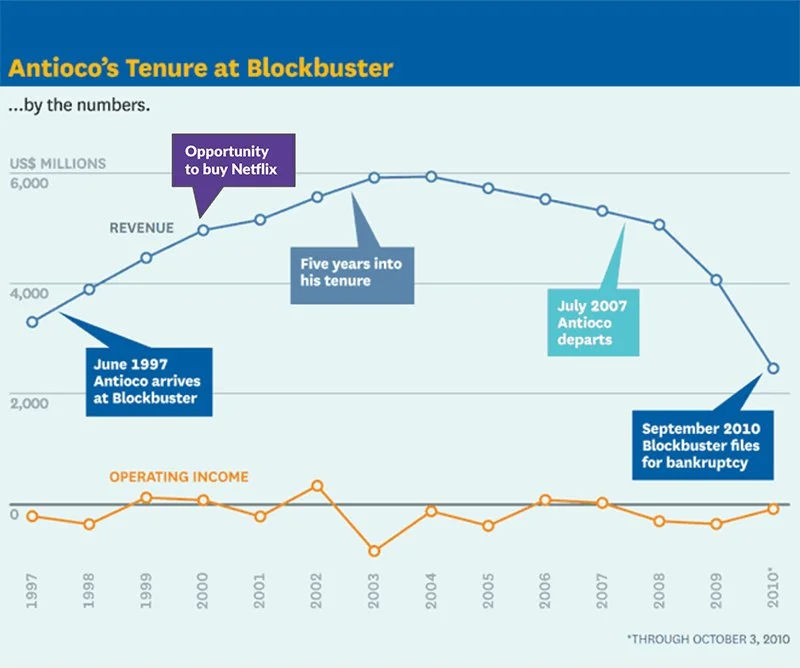

Above: Blockbuster grew for four years after passing on the opportunity to buy Netflix. It failed to transition to the next model, the seeds of its demise being planted years before they started to show up in the results. (Image Credit: Harvard Business Review April 2011)

Blockbuster grew for four more years after passing on the opportunity to buy Netflix.

It eventually tried to become a major player in online streaming, but it was too little, too late. After failing to convince investors to make the change, the company eventually fell into bankruptcy.

The seeds of its demise were planted years before they started appearing in the results.

As an aside, hearing both sides of a story is always helpful. Former CEO John Antioco recounted his fight with activist investors and his attempts to steer the company online in a Havard Business Review article in 2011 – “How I Did It: Blockbuster’s Former CEO on Sparring with an Activist Shareholder.”

💡 Takeaway: Blockbuster was riding high in 2000, but it was wedded to one model of doing things that ultimately led to its downfall.

3 Lessons for Leaders

Your Mission and your Model are Two Different Things

Don’t mistake your mission, which should be timeless and not change, with your model, which is how you accomplish your mission. Your mission doesn’t change, but your model will have to keep achieving your mission at scale.

Beware when Things are “Going Well”

There is a difference between present results and the underlying health of the organization. Often, results can be great today, but they hide what is truly happening under the surface. It’s easy to dismiss the small signs that indicate there may be a problem. Don’t ignore those small signs!

Cultivate an Outside Mindset

The problem with expertise is that the closer we are to what we do, the more narrow our perspective becomes. The antidote is to cultivate an Outside Mindset. An Outside Mindset seeks outside perspectives, leads with curiosity, is open to new ideas, pays attention to the outside world, and discerns

I’ve written about cultivating an Outside Mindset using a tool called the Imago Loop. To find out more, read Learning How to Cultivate an Outside Mindset.

Blockbuster is a sobering tale that I hope organizational leaders take seriously, and can see themselves in the story. It’s a reminder that even when you think you are at your highest high, you could be sowing the seeds for your eventual descent into irrelevance.

💡 Takeaway: By cultivating an Outside Mindset and differentiating your mission from your model, considering how your models may need to change, you can help make the necessary changes to transition to new models while staying focused on your mission.

Until next week… Surfs Up! 🌊

- Dave

About the Author | Dave Raley

Consultant, speaker, and writer Dave Raley is the founder of Imago Consulting, a firm that helps non-profits and businesses create profitable growth through sustainable innovation. He’s the author of a weekly trendspotting report called The Wave Report, and the co-founder of the Purpose & Profit Podcast — a show about the ideas at the intersection of nonprofit causes and for-profit brands.

Want to receive insights like this weekly?

Every Friday, we send out The Wave Report, highlighting one trend or insight “wave,” from donor and consumer trends to innovation in different industries or new models for growth.

Subscribe today to receive free weekly insights in your inbox here: